Guides

CN22 vs CN23 Customs Declarations: What's the Difference?

CN22 or CN23? Which Customs Form Should You Use for International Shipping

TL;DR

- If you ship low-value, lightweight goods, use CN22.

- If you ship higher-value, heavier, insured, or commercial goods, use CN23.

- Choosing the wrong customs declaration can lead to delivery delays, extra customs charges, or even rejected parcels.

In short, CN22 is for simple shipments, while CN23 is for anything that needs more detail and formal customs control. Picking the right form from the start saves time, money, and a lot of back-and-forth with postal services and customs offices.

Key Takeaways

- CN22 is used for low-value shipments, typically under €300 and under 2 kg

- CN23 is required for higher-value, heavier, or insured parcels

- CN23 almost always needs a commercial or proforma invoice attached

- Ecommerce sellers shipping internationally will usually use both CN22 and CN23, depending on the order value

- Using the correct customs form helps reduce customs delays, duty disputes, and delivery problems

When shipping goods internationally, a single label can be the difference between smooth delivery and a parcel stuck in customs limbo. For ecommerce businesses, marketplaces, and cross-border sellers, the most common and most important question is simple:

CN22 or CN23?

The right answer depends on parcel value, weight, contents, and shipping method, not guesswork. Choosing the correct customs declaration from the start keeps shipments moving, avoids unnecessary checks, and protects both the sender and the recipient from surprise fees or rejected parcels.

Stop losing time to customs issues. Use Bezos.ai to automate clearance paperwork and ship internationally with fewer delays.

What is a CN22 customs form?

A CN22 customs form is a simplified customs declaration used for low-value international shipments sent through standard postal services. It tells customs authorities what’s inside the parcel, how much it’s worth, and why it’s being shipped. Think of it as the quick, lightweight version of a full customs declaration.

You’ll typically use a CN22 form when:

- The parcel value is under €300 (or the local equivalent set by the destination country)

- The parcel weighs up to 2 kg

- The shipment is uninsured or only lightly insured

- The goods are simple, non-restricted, and low risk

Because it’s designed for smaller, straightforward shipments, the custom declaration CN22 doesn’t require extensive documentation. There’s no need for long item descriptions, tariff codes, or separate paperwork in most cases. That’s why it’s popular for everyday international post.

Common uses of CN22

The customs form CN22 is most often used for:

- Small ecommerce orders, especially low-ticket items

- Product samples sent to customers, partners, or influencers

- Gifts shipped between individuals

- Lightweight products sent via national postal services rather than couriers

For many online sellers, CN22 becomes the default choice for entry-level international orders where speed and simplicity matter more than detailed customs processing.

How the CN22 form is applied

The CN22 form is usually self-adhesive and placed directly on the outside of the parcel. It includes key details such as the sender and recipient information, a brief description of the contents, declared value, weight, and the reason for export (sale, gift, return, or sample).

Even though it’s a simplified customer declaration form, accuracy still matters. Incorrect values or vague descriptions can trigger customs checks, delays, or additional fees. When used correctly, though, CN22 helps parcels clear customs faster and keeps international shipping straightforward for low-value goods.

Shipping small orders internationally? See how Bezos.ai helps small ecommerce businesses streamline customs declarations.

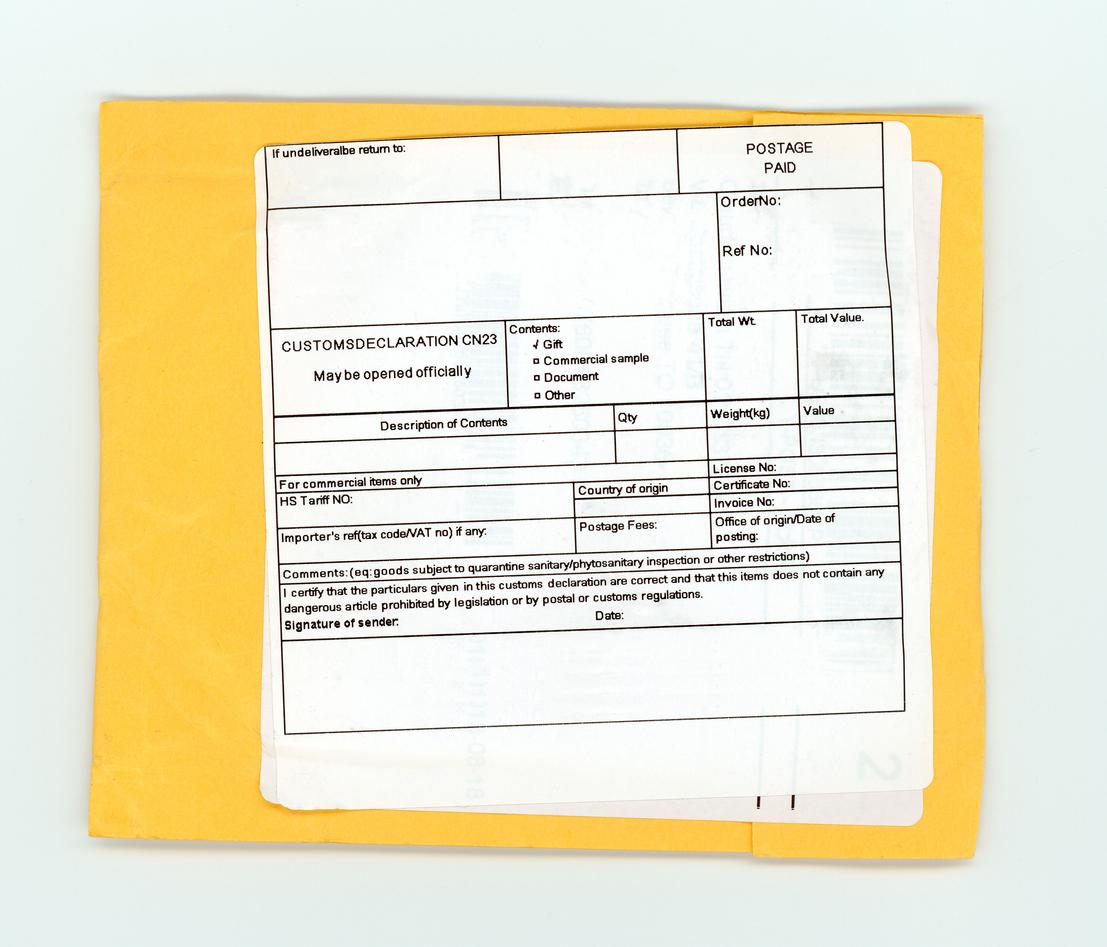

What is a CN23 customs form?

A CN23 customs form is a detailed customs declaration used for higher-value, heavier, or commercial international shipments. It gives customs authorities a full breakdown of what’s inside a parcel and how it should be assessed for duties, taxes, and import controls. When a shipment needs more than a basic label, CN23 is the form that gets used.

You must use a CN23 form when:

- The parcel value exceeds €300

- The shipment weighs over 2 kg

- The goods are insured or fully tracked

- The shipment contains commercial goods rather than personal items

- The destination country requires full customs documentation

In practice, many courier services and postal operators automatically trigger CN23 once these thresholds are crossed.

What information does a CN23 provide?

Unlike a simplified CN22, the CN23 gives customs officials everything they need to properly classify and assess the shipment. A cn23 form typically includes:

- Detailed item descriptions for each product

- HS tariff codes to classify goods correctly

- Country of origin for the items

- Sender and recipient tax details, such as VAT or EORI numbers when required

- Declared value and currency, clearly stated

Because this level of detail directly affects duties and VAT, accuracy is essential. Errors on a CN23 can lead to reassessments, customs holds, or unexpected charges for the recipient.

How the CN23 form is used

The CN23 is usually printed and placed in a clear document pouch on the outside of the parcel, often alongside a commercial or proforma invoice. This makes all documentation easily accessible to customs officers without opening the shipment.

For ecommerce sellers and businesses shipping internationally, CN23 is the standard customer declaration form for higher-value orders. It takes a bit more time to complete, but it also reduces risk, improves customs transparency, and helps parcels move through international borders with fewer surprises.

Tired of customs delays slowing growth? Let Bezos.ai handle CN23 forms and commercial invoices automatically.

CN22 vs CN23: What is the difference?

The difference between CN22 and CN23 comes down to value, weight, and how much detail customs needs to process your shipment. One is designed for simple, low-risk parcels. The other exists for shipments that require closer inspection and proper tax assessment.

Here’s a clear side-by-side breakdown to make the choice easier.

Why the difference matters

If your shipment crosses any CN23 threshold, you must use CN23. There’s no middle ground here. Even if the parcel is light but high in value, or low in value but fully insured, CN23 becomes mandatory.

Using CN22 when CN23 is required can lead to real problems, including:

- Customs delays while authorities request missing information

- Additional inspections that slow delivery

- Returned parcels sent back to the sender

- Unexpected duties, taxes, or handling fees charged to the recipient

From a customs perspective, the cn22/cn23 decision signals how seriously a shipment needs to be reviewed. CN22 tells customs “this is simple.” CN23 tells them “this needs proper documentation.”

For ecommerce sellers and regular international shippers, understanding the CN22/23 split helps avoid costly mistakes and keeps parcels moving without unnecessary friction.

When should ecommerce businesses use CN22 or CN23?

For ecommerce sellers, the rule is refreshingly simple:

- Low-value orders → CN22

- Higher-value orders → CN23

The complexity only creeps in when stores try to manage this manually. At scale, even a small mistake in customs paperwork can turn into delayed deliveries, refunds, or unhappy customers.

How ecommerce stores typically use CN22 and CN23

Most ecommerce businesses shipping internationally will:

- Use CN22 for small, low-ticket orders sent via standard postal services

- Switch automatically to CN23 as order value, weight, or insurance increases

This split happens constantly in real-world ecommerce. A lightweight accessory might ship with a CN22 form, while the exact same product ordered in multiples or bundled with insurance suddenly requires a CN23.

Why automation matters

This is where shipping software and fulfilment partners make a real difference. They apply CN22 or CN23 rules automatically based on order value, parcel weight, destination country, and shipping method. That removes guesswork and keeps declarations consistent.

Relying on manual decisions increases risk as order volume grows. One incorrectly labeled parcel can trigger customs checks, delay dozens of similar shipments, and create extra work for support teams.

For ecommerce businesses, using the right customs declaration CN22 or CN23 at the right moment is about protecting delivery times, margins, and the overall customer experience.

Shipping internationally at scale? Let Bezos.ai automatically choose CN22 or CN23 for every order

Do I need a commercial invoice with CN23?

Short answer: yes, in most cases you do.

Shipments that require a CN23 almost always need supporting paperwork, and that usually means:

- A commercial invoice for goods that have been sold, or

- A proforma invoice for samples, returns, or non-commercial shipments

The invoice works hand in hand with the CN23 declaration. While the CN23 explains what’s in the parcel, the invoice gives customs the numbers they need to process it properly.

Why the invoice matters

Customs authorities use the invoice attached to a CN23 form to calculate:

- Import duties

- VAT

- Other local taxes or handling charges

It also helps them verify that the declared value, product description, and reason for export all line up. When those details match, parcels tend to move much faster.

What happens if you skip the invoice?

Without a proper invoice, CN23 shipments are often delayed or stopped. Customs may request additional documents, hold the parcel for inspection, or even reject it outright and send it back to the sender.

For ecommerce sellers, including the right invoice with every CN23 shipment isn’t just a formality. It’s one of the easiest ways to avoid delays, reduce disputes over duties, and keep international deliveries running smoothly.

What happens if I use the wrong customs form?

Using the wrong customs form might seem like a small mistake, but it can cause big headaches once a parcel reaches the border. Customs authorities rely on CN22 and CN23 to decide how a shipment should be handled. When the paperwork doesn’t match the parcel, things slow down fast.

What can go wrong

If the wrong form is used, shipments can run into issues such as:

- Customs clearance delays while authorities request missing or corrected information

- Extra inspection or handling fees added by customs or postal operators

- Parcels returned to the sender, often after weeks of waiting

- Unhappy customers, followed by refunds, chargebacks, or support tickets

For ecommerce businesses, these problems don’t just cost money. They damage trust.

Common customs form mistakes

The most frequent issues customs teams see include:

- Using CN22 for high-value or insured orders that clearly require CN23

- Missing commercial or proforma invoices with CN23 shipments

- Vague item descriptions that don’t clearly explain what’s inside the parcel

- Incorrect declared values, either by accident or in an attempt to reduce duties

Why getting it right matters

Correct customs paperwork is not optional. It’s part of the delivery promise you make to your customer when they place an order. Using the right customs declaration CN22 or CN23 helps shipments move faster, keeps costs predictable, and avoids unnecessary friction at the border.

In international shipping, good paperwork is just as important as good packaging.

Avoid customs errors. See how Bezos.ai reduces failed international deliveries.

Do gifts require CN22 or CN23?

Yes, they do. Gifts still need a customs declaration when shipped internationally.

The same basic rules apply:

- Low-value gifts → CN22

- Higher-value gifts → CN23

Customs authorities still need to know what’s inside the parcel, how much it’s worth, and where it’s going, even if no money changed hands.

A common gift-shipping myth

Marking an item as a gift does not automatically exempt it from customs checks, duties, or taxes. Many countries have gift allowances, but those limits vary by destination and are often lower than people expect.

If a gift exceeds the value or weight limits for CN22, or if it’s insured or tracked, CN23 is required, just like with commercial shipments.

Best practice for shipping gifts

Whether you’re sending a personal present or a promotional gift to a customer, accuracy matters. Use clear item descriptions, declare a realistic value, and choose the correct CN22 or CN23 form based on the parcel, not the purpose.

Getting the paperwork right helps gifts arrive on time and avoids awkward surprises for the recipient at the door.

Where do you attach CN22 and CN23 forms?

Where you place the customs form matters more than people think. Even correctly completed paperwork can cause delays if it’s not easy for customs officers to find.

Here’s how it works in practice:

- CN22 is stuck directly onto the outside of the parcel. It’s usually self-adhesive and placed next to the shipping label so it’s clearly visible.

- CN23 is placed inside a clear document pouch on the outside of the parcel, often together with the commercial or proforma invoice.

Why placement matters

Customs officers need quick access to the declaration without opening the parcel. If a CN22 is hidden, damaged, or covered by tape, or if a CN23 isn’t visible in its pouch, the shipment may be pulled aside for manual review.

Incorrect placement can slow down processing, trigger extra checks, or send the parcel back for clarification. Keeping forms visible, secure, and easy to read helps parcels move through customs with fewer interruptions.

Conclusion

Choosing between CN22 and CN23 isn’t a matter of preference. It’s about compliance, delivery speed, and the overall customer experience.

If you ship internationally:

- Use CN22 for simple, low-value parcels

- Use CN23 for higher-value, commercial, or insured shipments

- Always include clear item descriptions and the correct invoice when required

The right customs declaration CN22 or CN23 helps parcels clear borders faster, avoids unnecessary fees, and reduces delivery issues. Get the paperwork right, and everything else in the shipping process tends to run a lot more smoothly.

Ship globally with confidence. Talk to Bezos.ai about end-to-end international fulfilment and customs automation.

FAQ

Which customs form should I use for international shipping, CN22 or CN23?

Use CN22 for low-value, lightweight parcels, and CN23 for higher-value, heavier, or commercial shipments. The choice depends on the parcel, not personal preference.

What is the value limit for CN22?

CN22 is typically used for shipments valued up to €300, though exact limits can vary slightly depending on the postal service and destination country.

How do I fill out a CN23 form correctly?

Provide clear item descriptions, include HS tariff codes, list the country of origin, declare accurate values and currency, and attach a commercial or proforma invoice. Consistency across all documents is key.

Does my parcel require a customs declaration?

Yes. Any goods shipped internationally require a customs declaration, whether it’s a sale, a gift, a return, or a sample.

Where can I get CN22 and CN23 forms?

You can get them from postal services, shipping software platforms, or fulfilment providers such as Bezos.ai, which typically generates the correct form automatically based on your shipment details.

Is a commercial invoice needed with CN23?

In most cases, yes. CN23 shipments usually require a commercial invoice for sold goods or a proforma invoice for samples and returns.

What happens if I use the wrong form?

Your parcel may be delayed, inspected, returned to sender, or hit with additional duties and handling fees. Using the correct form helps avoid all of that.

As a part of the Bezos.ai team, I help e-commerce brands strengthen their fulfilment operations across the UK, Germany, the Netherlands and the US. I work with merchants that want to simplify logistics, reduce costs and expand into new markets. I’m also building my own e-commerce brand, which gives me practical insight into the challenges founders face. In my writing, I share fulfilment strategies, growth lessons and real-world advice drawn from both sides of the industry.